2017-Q3 Market and Economic Overview

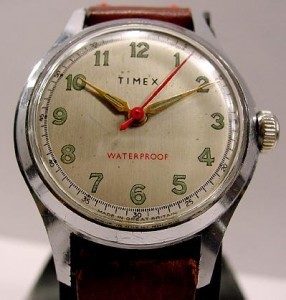

In the 1950s, Timex hired Mickey Mantle to pitch their wristwatch with the phrase, “It takes a licking and keeps on ticking.” That marketing pitch was used for over four decades and is considered one of the best advertising campaigns of all time.

In the 1950s, Timex hired Mickey Mantle to pitch their wristwatch with the phrase, “It takes a licking and keeps on ticking.” That marketing pitch was used for over four decades and is considered one of the best advertising campaigns of all time.

Perhaps the stock market should adopt the Timex tagline. In spite of a nuclear chess game with North Korea, multiple natural disasters, and a deadlocked Congress, the US economy “takes a licking and keeps on ticking.”

With the third quarter of 2017 now in the history books, the S&P 500 has had eight consecutive quarters of positive returns.1 That is a remarkable feat. Even more remarkable is the low volatility. So far this year we have only seen 5% of trading days with a move in the S&P 500 of greater than +/- 1%. This is the lowest level of volatility since they first began tracking this data in 1982.2

We are also witnessing the third-longest economic expansion on record. Barring an escalation with North Korea, the consensus among economists is that they don’t see anything on the horizon that would change our current course. Inflation is under control, interest rates are low, and the market has already factored in the Fed’s decision to begin quantitative tightening. In short, the economy is neither too hot nor too cold.

Knowing that American businesses have long been hoping for a tax break (we have some of the highest corporate tax rates in the world), we have been impressed that the stock market has remained positive in spite of little action on tax reform. When the tax blueprint was rolled out last month, one political blog dryly observed, “Six Republicans crafted the tax blueprint behind closed doors. Now 535 lawmakers and thousands of lobbyists will have a say in the detail.”3 And yet still the stock market keeps on ticking….

Many foreign countries are experiencing accelerated growth and we see the global economy picking up steam. The Eurozone economy is strengthening, and China continues to enjoy strong growth—projected at 6.7% for 2017. Although some regions in the world are still weak, most global investments have performed well.

As for the remainder of 2017, the fourth quarter is typically an active one. Since the markets are at all-time highs, some type of correction would not be surprising. But because of the low volatility in the markets, we believe investors should be cautiously optimistic. This has not been a glamorous eight-year bull market—and it certainly has been ignored by the media. But, like an old Timex watch, this bull market still keeps on ticking long after more dynamic bull markets have bit the dust.

The opinions expressed here should not be construed as investment advice and are subject to change with market conditions. Securities offered through Securities America, Inc., member FINRA/SIPC. Philip O. Johnson and Marcus F. Johnson are registered representatives with Securities America, Inc. Johnson Financial Advisors and Securities America Inc. are unaffiliated firms. 1) The S&P 500 is an unmanaged group of securities considered to be representative of the stock market in general. An investment cannot be made directly into an index. 2) Schwab.com 3) Politico.com

Investing involves risk, including loss of principal. Stock and bond values fluctuate in price so that the value of an investment can go down depending on market conditions. Stock prices may fluctuate due to stock market volatility and market cycles, as well as circumstances specific to a company. The two main risks related to fixed income investing are interest rate risk and credit risk. Investments in foreign markets entail special risks such as currency fluctuations, political developments, economic and market instability. Diversification does not ensure a profit nor protect against loss in a declining market.