The Coronavirus and Your Portfolio

On February 19th the U.S. stock market reached new highs, continuing a bull market which is almost 11 years old. But the celebration was short-lived as concerns over the coronavirus (COVID-19) led to a market correction this past week. This sell-off was triggered by fear (because we do not yet know the facts). Key concerns are:

- How fast will the virus spread? What areas will be affected? What will be the impact here at home?

- Will this affect consumer spending, which is a major contributor to our economy?

- How much will the global supply chain be impacted? Many U.S. companies rely on Asian manufacturing or parts.

Keeping a Steady Hand

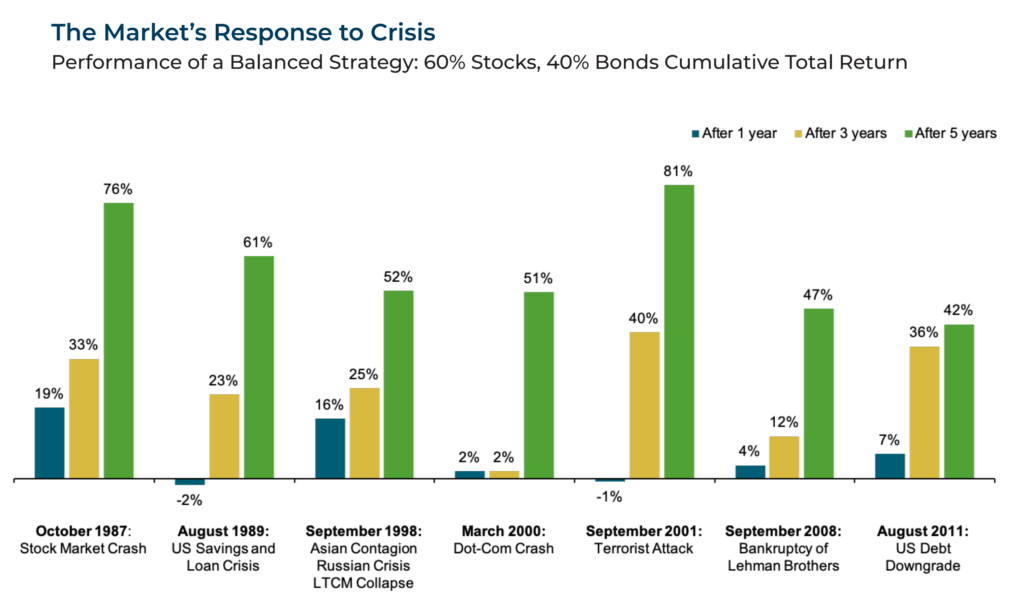

The below chart helps us understand why keeping a long-term perspective is important. Researchers recently looked at the seven worst financial crises over the past forty years. Note that one year after each crisis, the U.S. stock market was in positive territory (blue column) except in two cases when it was down 1% or 2% respectively. But in every case the market had positive gains at three years and five years following a crisis. Although past performance does not guarantee future results, it helps to understand that market corrections should not derail your long-term strategy.

Understanding Emotion

A potential pandemic is unsettling at a human level and can be very disruptive at an economic level. Although we talk about markets, we do not forget that the real impact of the coronavirus involves individuals, families and communities. We hope that governments, the world-wide medical community, and pharmaceutical companies will work together to help stem this outbreak.

Because we don’t know how this virus will play out, the markets may continue to be volatile until the outbreak begins to slow down.

In the meantime, keep moving forward with life. If you were previously planning to withdraw funds from your investments, go ahead and do so. If you were planning to add to your investments, go ahead and do so. A client recently called and said that she might delay remodeling her kitchen. We said, “No, move forward.” (Even with this downturn, her portfolio is at the level it was a few months ago.)

In the meantime, keep moving forward with life. If you were previously planning to withdraw funds from your investments, go ahead and do so. If you were planning to add to your investments, go ahead and do so. A client recently called and said that she might delay remodeling her kitchen. We said, “No, move forward.” (Even with this downturn, her portfolio is at the level it was a few months ago.)

What is important is that you are comfortable with your investments. If you feel your risk is too high, we can adjust that. If you see this as a buying opportunity, we can discuss it. Whatever is on your mind, don’t hesitate to reach out and talk to us. One client (who is a seasoned investor and understands downturns) sent us an email listing all the things he knew we would tell him and ended with, “Time for a deep breath and hang on.”