Catch-Up Contributions: How They Can Help Boost Retirement Savings

Retirement planning can be a daunting task, and for many individuals, it can be difficult to save enough money to ensure a comfortable retirement. According to a recent survey by the Employee Benefit Research Institute (EBRI), 27% of workers are not confident about having enough money to live comfortably through their retirement years, while only 28% are very confident.

Fortunately, in 2001, the U.S. Congress passed the Economic Growth and Tax Relief Reconciliation Act, which included a provision known as the “catch-up” contribution. This provision allows individuals who are 50 years of age or older to make additional contributions to their qualified retirement plans, above the limits imposed on younger workers.

How it Works

The current annual contribution limit for traditional 401(k) plans in 2022 is $20,500. However, individuals who are over 50 years old, or who will turn 50 before the end of the year, may be eligible to contribute up to $27,000 in 2022. This extra $6,500 per year can potentially make a significant difference in the eventual balance of the account, and by extension, in the income the account may generate.

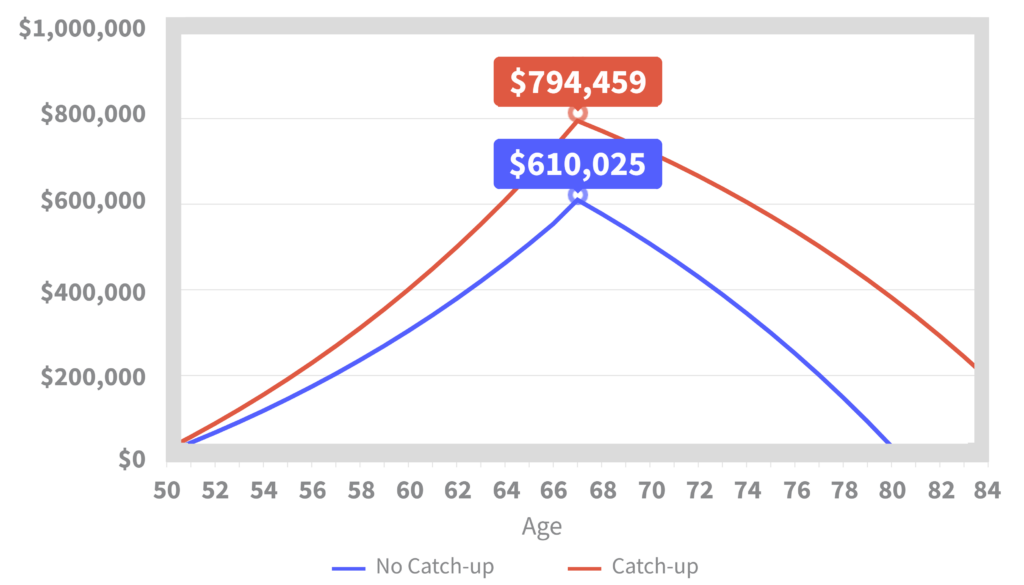

To illustrate the potential impact of catch-up contributions, consider the following hypothetical example. The accompanying chart traces the hypothetical balances of two 401(k) plans. The blue line represents a 401(k) account into which $20,500 annual contributions are made each year, while the red line represents a 401(k) account into which an additional $6,500 in contributions are made each year, for a total of $27,000 in contributions annually.

Both accounts assume an annual rate of return of 5%. Upon reaching retirement at age 67, both accounts begin making withdrawals of $6,000 per month. The hypothetical account without catch-up contributions will be exhausted by the time its beneficiary reaches age 81.

It’s important to note that the IRS regularly updates these maximum contribution limits, and that fees and other expenses were not considered in this illustration. Actual returns may vary, and the rate of return on investments will vary over time, particularly for longer-term investments.

Bottom Line

Catch-up contributions can potentially help boost retirement savings and make up for lost time. However, it’s important to keep in mind that withdrawals from 401(k) plans and most other employer-sponsored retirement plans are taxed as ordinary income and, if taken before age 59½, may be subject to a 10% federal income tax penalty. In most circumstances, individuals must begin taking required minimum distributions from their 401(k) or other defined contribution plan in the year they turn 73.

It’s also important to consider other retirement savings strategies in addition to catch-up contributions. These may include taking advantage of employer matches, contributing to a Roth IRA, and seeking professional financial advice.

Conclusion

Retirement planning can be challenging, but catch-up contributions can provide a valuable opportunity for individuals to boost their retirement savings. By contributing an extra $6,500 per year to a qualified retirement plan, individuals can potentially make a significant difference in their eventual retirement income. However, it’s important to consider other retirement savings strategies and to seek professional financial advice to ensure a comfortable retirement.

If you’re looking for professional advice on how to maximize your retirement savings, Johnson Financial Advisors can help. Their team of financial professionals can provide personalized guidance and recommendations to help you meet your retirement goals.

In addition to catch-up contributions, Johnson Financial Advisors can help you explore other retirement savings strategies, such as employer matches, Roth IRAs, and more. They can also help you navigate the complex tax laws and regulations that come with retirement planning.

With Johnson Financial Advisors on your side, you can feel confident that you’re making the most of your retirement savings opportunities. Contact them today to schedule a consultation and start planning for your future.

Sources:

- Employee Benefit Research Institute (EBRI), 2022

- Economic Growth and Tax Relief Act of 2001

- Internal Revenue Service (IRS), 2022. Catch-up contributions are also allowed for 403(b) and 457 plans.

In most circumstances, you must begin taking required minimum distributions from your 401(k) or other defined contribution plan in the year you turn 73. Withdrawals from your 401(k) or other defined contribution plans are taxed as ordinary income, and if taken before age 59½, may be subject to a 10% federal income tax penalty.

The information in this material is not intended as tax or legal advice. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation.